Introduction

In the world of investments, the common belief is that in order to achieve high returns, one must take on high risks. However, this is not always the case. There are strategies that can help you double your money without exposing yourself to unnecessary risks.

In this article, we will explore 10 foolproof strategies on How to Double Your Money Without Risk. From the power of compounding to high-yield investments and high-value stocks, these strategies will guide you towards wealth creation and faster returns. So if you’re looking to make your money work harder for you, keep reading to discover the best investments that can make you rich without taking any risks.

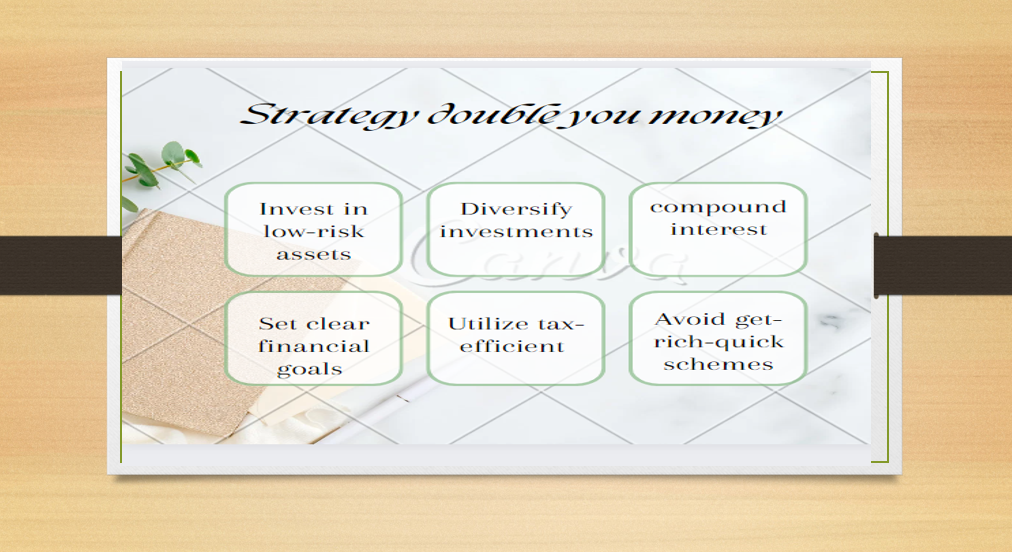

Strategies On How to Double Your Money Without Risk

The power of doubling your money lies in the concept of compound interest. Compound interest is when the interest earned on an investment is again invested, leading to powerful growth over time. This powerful strategy allows you to double your investment without taking on any additional risk.

One way to take advantage of compound interest is through high-yield savings accounts or certificates of deposit (CDs). These low-risk investments offer competitive interest rates and allow your money to grow steadily over time. Additionally, consider investing in blue-chip stocks or index funds, which have a history of consistent growth and dividends.

It’s important to remember that doubling your money takes time and patience. Be prepared to make long-term investments and resist the temptation to withdraw your funds prematurely. By employing the power of doubling your money through compound interest, you can achieve significant financial growth without exposing yourself to unnecessary risks. Stay tuned for more strategies on doubling your money without taking any risks in the next section.

Strategy 1: Invest in low-risk assets

Strategy 1: Invest in low-risk assets

One of the key ways to double your money without taking any risks is to invest in low-risk assets. These are investments that have a lower chance of losing value and are more likely to provide stable returns over time.

High-yield savings accounts and certificates of deposit (CDs) are excellent options for those looking for low-risk investments. These types of investments offer competitive interest rates and the added advantage of compound interest. By reinvesting the interest earned, your money has the potential to double over time.

Another low-risk investment option is to consider blue-chip stocks or index funds. Blue-chip stocks are shares of well-established companies that have a history of consistent growth and dividends. Index funds, on the other hand, offer a diverse portfolio of stocks and are designed to track the performance of a specific market index.

When investing in low-risk assets, it’s crucial to have a long-term perspective and resist the urge to withdraw your funds prematurely. Give your investments time to grow and take advantage of the power of compound interest. In the next section, we’ll explore more strategies to help you double your money without taking on any additional risks.

Strategy 2: Diversify your investments..

Strategy 2: Diversify your investments

Diversification is a crucial strategy when it comes to doubling your money without taking any risks. By spreading your investments across different asset classes, industries, and geographical regions, you reduce the impact of any single investment on your overall portfolio.

One way to achieve diversification is to invest in mutual funds or exchange-traded funds (ETFs) that offer a mix of stocks, bonds, and other assets. These funds are managed by professionals who carefully select a diversified portfolio of investments on your behalf.

Another way to diversify is by investing in different industries or sectors. For example, if you own stocks in the technology sector, consider adding some holdings in healthcare or consumer goods. This way, even if one industry falters, the performance of other sectors can offset any losses.

Additionally, consider diversifying your investments across different geographical regions. By investing in international markets, you can take advantage of opportunities and potential growth in different economies.

Remember, diversification doesn’t guarantee profits or protect against losses, but it does help manage risk. In the next section, we will uncover more strategies to further enhance your chances of doubling your money without taking any risks.

Strategy 3: Take advantage of compound interest

Strategy 3: Compound interest so powerful tool that it can significantly increase your wealth over time. It is essentially the interest earned on both the initial investment and the accumulated interest from previous periods. By reinvesting your earnings, you can maximize your returns without taking any additional risks.

One way to leverage compound interest is by investing in savings accounts or certificates of deposit (CDs) that offer compound interest. These financial instruments allow your money to grow over time, as the interest earned is added to your initial investment, creating a compounding effect.

Another way to take advantage of compound interest is through retirement accounts, such as 401(k)s or Individual Retirement Accounts (IRAs). These accounts provide tax advantages, and the earnings grow tax-deferred until you withdraw the funds upon retirement. By consistently contributing to your retirement account and letting the power of compound interest work its magic, you can greatly boost your savings.

However, it is crucial to start investing early to fully capitalize on compound interest. The longer you allow your investments to grow, the greater the impact of compound interest on your wealth.

In the next section, we will explore additional strategies that can help you double your money without taking any risks. Stay tuned!

Strategy 4: Utilize tax-efficient investment vehicles

Strategy 4: One often overlooked aspect of investing is the impact that taxes can have on your returns. By utilizing tax-efficient investment vehicles, you can minimize the amount of taxes you pay and increase your overall wealth.

One such tax-efficient investment option is a tax-exempt municipal bond. These bonds are issued by state and local governments and the interest earned from them is typically not subject to federal income tax. This means that the returns you receive from these bonds are not reduced by taxes, allowing you to keep more of your money.

Another tax-efficient investment vehicle is a Roth IRA. With a Roth IRA, your contributions are made with after-tax dollars, meaning that you do not have to pay taxes on the withdrawals you make during retirement. This can be a huge advantage, as it allows your money to grow tax-free, resulting in potentially significant tax savings over time.

In addition to tax-exempt municipal bonds and Roth IRAs, there are other tax-efficient investment options to explore. These include index funds, which typically have lower turnover and capital gains distributions, and tax-managed funds, which are specifically designed to minimize taxes.

By utilizing tax-efficient investment vehicles, you can effectively grow your wealth without the burden of excessive taxes. In the next section, we will dive into another foolproof strategy that can help you achieve your goal of doubling your money without taking any risks. Stay tuned!

Strategy 5: Set clear financial goals and stick to them

Setting clear financial goals is essential when it comes to doubling your money without taking any risks. Without a clear plan in place, it is easy to get swayed by market fluctuations or impulsive investment decisions.

Start by defining your financial goals. Do you want to save for a down payment on a house, fund your children’s education, or retire early? Once you have identified your goals, break them down into smaller milestones. This will make them more achievable and allow you to track your progress along the way.

After setting your goals, it’s crucial to stick to them. Develop a budget that aligns with your objectives and prioritize saving and investing. Automate your savings and diligently contribute to your investment accounts regularly.

Remember to periodically review and reassess your goals as your circumstances change. Life is unpredictable, and it is essential to adjust your financial plan accordingly.

By setting clear financial goals and sticking to them, you are laying a solid foundation for doubling your money without taking unnecessary risks. In the next section, we will explore another strategy that will further enhance your investment portfolio. Stay tuned!

Strategy 6: Regularly review and adjust your investment portfolio

Once you have established your financial goals and started saving and investing, it is important to regularly review and adjust your investment portfolio. This strategy ensures that your investments continue to align with your objectives and adapt to changing market conditions.

Schedule regular check-ins to assess the performance of your investments and make any necessary adjustments. This could involve rebalancing your portfolio to maintain your desired asset allocation or reallocating funds to take advantage of new investment opportunities.

Keep in mind that your investment goals may change over time, and it is important to adjust your portfolio accordingly. For example, as you get closer to retirement, you may want to shift towards more conservative investments to protect your capital.

By regularly reviewing and adjusting your investment portfolio, you can maximize your chances of doubling your money without taking unnecessary risks. In the next section, we will explore another strategy that will further enhance your investment growth. Stay tuned!

Strategy 7: Seek guidance from financial experts

Seeking guidance from financial experts can be a valuable strategy to help you double your money without taking any risks. Financial experts have the knowledge and experience to analyze market trends, identify potential investment opportunities, and provide expert advice tailored to your financial goals.

When selecting a financial expert, consider their credentials, experience, and track record. Look for professionals who have a solid understanding of different investment strategies and a good reputation within the industry.

Once you have found a trusted financial expert, make sure to have open and honest communication. Clearly communicate your financial goals, risk tolerance, and investment preferences. This will help the expert tailor their recommendations to your specific needs.

Remember, seeking guidance from financial experts does not mean blindly following their advice. It is important to do your own research and fully understand the risks associated with any investment before making a decision.

In the next section, we will discuss the importance of diversification in your investment portfolio. Stay tuned!

Strategy 8: Avoid get-rich-quick schemes

One of the biggest mistakes people make when trying to double their money without taking any risks is falling for get-rich-quick schemes. These schemes often promise huge returns in a short period of time, but they rarely deliver on their promises.

Get-rich-quick schemes usually involve investing in high-risk investments that have the potential for big returns, but also a high probability of losing your money. These investments may seem tempting, especially if you’re eager to see your money grow quickly, but they often end up leaving investors with significant losses.

Instead of falling for get-rich-quick schemes, focus on sound investment strategies that have a proven track record of success. Diversifying your portfolio, as we will discuss in the next section, is one such strategy that can help minimize the risks associated with investing and increase your chances of doubling your money over time.

Stay tuned for the next section where we will dive deeper into How to Double Your Money Without Risk.

Strategy 9: Stay informed and educated about the financial market

In order to double your money without taking any risks, it’s essential to stay informed and educated about the financial market. By keeping up with the latest news and trends, you can make informed decisions about your investments and identify potential opportunities for growth.

One way to stay informed is to regularly read financial publications and websites that provide reliable information and analysis. These sources can help you gain a deeper understanding of market trends, economic indicators, and investment strategies.

Additionally, it’s crucial to continuously educate yourself about various investment options and strategies. Attend seminars, webinars, or workshops, or even consider enrolling in online courses related to investing and financial planning. The more knowledge you acquire, the better equipped you’ll be to make informed decisions and navigate the ever-changing financial landscape.

Remember, staying informed and educated is an ongoing process. By staying proactive and continuously updating your knowledge, you can maximize your chances of successfully doubling your money without taking unnecessary risks.

In the next section, we will explore another meaningful strategy to help you achieve your financial goals. Stay tuned!

Strategy 10: Be patient and committed to long-term wealth building

Strategy 10: Building wealth is a long-term game, and it requires patience and commitment. While it’s tempting to look for quick gains and get-rich-quick schemes, the reality is that sustainable wealth is built over time. By adopting a long-term mindset, you can avoid making impulsive decisions based on short-term market fluctuations.

Investing in stocks or other assets with a strong track record of long-term growth is a smart strategy. By focusing on quality investments and holding them for the long haul, you can benefit from compounding returns. Over time, your investments have the potential to grow exponentially and significantly increase your wealth.

It’s important to remember that the market will have its ups and downs, but history has shown that it tends to trend upwards over the long run. By staying committed to your investment strategy and resisting the urge to react to short-term market fluctuations, you give your investments the best chance to grow steadily and double your money.

In the next section, we will discuss the importance of diversification in minimizing risks and maximizing returns. Stay tuned for more valuable insights on doubling your money without taking any risks!

Conclusion

Conclusion

In conclusion, doubling your money without taking any risks is not an easy feat, but it is definitely possible with the right strategies in place. We have discussed ten foolproof strategies to help you achieve this goal, from automating your savings to investing in proven assets.

It is important to remember that these strategies require patience, discipline, and a long-term mindset. Building wealth takes time, and quick gains are often short-lived. By staying committed to your financial goals and making informed decisions, you can steadily increase your wealth over time.

Additionally, diversification is key to minimizing risks and maximizing returns. By spreading your investments across different asset classes, industries, and geographical locations, you can protect yourself from market volatility and potentially earn higher returns.

Remember, the ways on How to Double Your Money Without Risk may not be easy, but with dedication and a sound financial plan, it is within reach. Stay focused, stay patient, and watch your wealth grow. Good luck!

Also read related article Financial mistakes to avoid

Pingback: Best Finance Books for Women | Moneyymagnett.com